Commercial entities regularly incur different types of costs while carrying out their business activities. These costs can be broadly bifurcated into costs related to the core production/trading activities and other ancillary costs. While preparing their books of accounts, manufacturing entities in particular prepare a separate trading account and a separate profit and loss account. They prepare trading account to record all incomes and expenses related to their manufacturing operations. The result shown by this account is the entity’s gross profit or gross loss which is transferred to the profit and loss account which further records all non-manufacturing incomes and expenses and shows its result in the form of net profit or net loss. In order that gross profit and net profit are appropriately reflected, it is important that costs are bifurcated correctly.

This article looks at meaning of and main differences between the two such cost bifurcations – product cost and period cost.

Definitions and meanings

Product cost:

A product cost is the cost that directly relates to and is attributable to products purchased or manufactured by a business entity. For a manufacturing entity, product costs include all costs that are incurred to acquire raw materials and to ultimately convert them to salable finished goods through a manufacturing process. Product costs typically include all types of direct materials, wages associated with direct labor workers and manufacturing overheads.

Product cost = Direct materials + Direct labor + Manufacturing overhead

In financial accounting, product costs are initially carried as inventory in the books and are reflected as a current asset in the balance sheet. Once the goods are sold, the inventory is charged to the trading account in the form of cost of goods sold. This treatment of capitalizing the costs first and then charging as an expense is in line with the matching principle of accounting. Thus, the product costs are expensed out as cost of goods sold only when the related income from sale of goods is realized and recorded. Product costs are also often termed as inventoriable costs and manufacturing costs.

Examples of product costs:

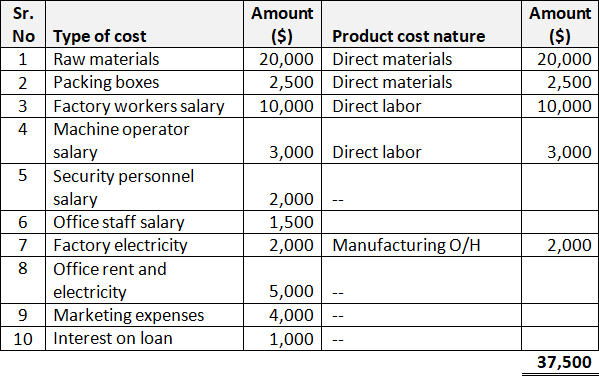

Alfred Toys Inc. manufactures toy cars. It has incurred the following costs for the production of 10,000 toy cars during the month of April 2021:

In the above table, Alfred’s total product cost to manufacture 10,000 toy cars is $37,500 which consists of raw materials, packaging materials, factory workers’ salary, machine operator’s salary and factory electricity. This cost should be recorded as inventory which will stay on balance sheet till the goods are sold. The per unit product or manufacturing cost can be computed as follows:

= $37,500/10,000 units

= $3.75

Period cost:

Period cost (often referred to as period expense) is any other cost that is incurred by the entity that does not directly relate to the entity’s manufacturing process. While the production process is the core activity for a manufacturing entity, there are several other activities that it must conduct to keep its operations running. These can include administrative, logistical, financial, distribution, sales and marketing functions etc. Costs incurred on these other business activities that are not specifically linked to the manufacturing process qualify as period costs.

As the name suggests, period costs are those costs which are incurred due to the passage of time. They don’t form part of the cost of inventory and thus are expensed to the profit and loss account as and when they are incurred by the entity. Such a treatment of period costs is in accordance with the accrual concept of financial accounting.

Examples of period costs:

In the above example, security personnel salary, office staff salary, office rent and electricity, marketing expenses and interest costs all qualify as period costs and hence don’t form part of the company’s product or inventory. To expense these costs, the Alfred don’t need to wait till its toy cars are sold, rather it will expense them out during April (i.e., the month of incurrence) because these are period costs and will not be added to the inventory.

Difference between product cost and period cost

The eight key points of difference between product cost and period cost have been detailed below:

1. Meaning

- Products costs are the costs that are incurred in the course of a manufacturing process and that can be related to the products manufactured.

- Period costs are all other costs incurred during the business operations of the entity but which are not related to the manufacturing process.

2. Part of inventory costs

- Product costs are incurred to manufacture or acquire goods and thus necessarily form part of the cost of inventory.

- Period costs do not form part of inventory costs and are, therefore, accounted for separately.

3. Reason for incurrence

- The core production activities (in case of a manufacturing entity) and purchasing activities (in case of a trading entity) are the principal reasons of incurring product costs.

- All other business activities such as administrative activities, financing activities, selling activities etc. which are part of an entity’s overall functioning are the reasons for which period costs are incurred. Essentially, these costs are the function of passage of time.

4. Accounting treatment

- Product costs are initially capitalized as current asset and recorded as inventory in the books of accounts. Once the related inventory is sold, the product cost is transferred to the cost of goods sold account and debited to the trading account as an expense.

- Period costs are accounted for as expenses in the profit and loss account. This treatment of period cost is in accordance with the accrual accounting principle.

5. Timing of recognition as expense

- Product costs are recognized as expense in the year of sale.

- Period costs are recognized as expense in the year of incurrence itself.

6. Impact on profitability

- Product costs impact gross profitability.

- Period costs impact net profitability.

7. Nature

- Product costs are generally variable or semi variable in nature as they are related to the production activity and vary in relation to the level of output.

- Period costs, on the other hand, are more fixed in nature as they do not vary directly with a change in the level of output.

8. Examples

- Product costs include raw materials, wages of labor involved in production process and other overheads attributable tot the production process.

- Period costs include office expenses, sales and marketing expenses, insurance costs, finance costs etc.

Conclusion – product cost vs period cost:

The key difference between product cost and period cost is that the former is primarily linked with the production or acquisition of product inventory while the latter is associated with other activates needed to keep the business functioning. In financial accounting, product costs are accumulated in the books as inventory which is initially represented as a current asset in balance sheet. When a certain number of units from inventory are sold, the cost of those units from inventory account is expensed out as cost of goods sold. On the other hand, no portion of period costs goes to the inventory account. These costs, in their entirety, are expensed out immediately at the time of their incurrence.

Both product costs and period costs greatly impact the business profitability. While their bifurcation is important to reveal gross and net margins, it also assists in cost analysis and control. Management can identify cost overrun areas by periodically analyzing both product costs and period costs. This can eventually help the entity take corrective action to lower costs and improve profitability.