Product pricing is a key aspect of every business entity that calls for thorough management attention. Determining the price at which an entity sells its goods is important as it forms the basis of earning profits which is the core purpose of every commercial business. In order to determine prices, knowing the costs incurred and attributable to each product/cost center is essential. For this purpose, accountants prepare cost sheets of each product/cost center. All costs are bifurcated into direct costs and indirect costs to facilitate attribution to each product/cost center.

This article looks at meaning of and key differences between these two types of costs – direct cost and indirect cost.

Definitions and meanings

Direct cost:

Direct costs are those costs incurred by an entity that are directly related to its core production activity. In other words, these costs are directly traceable and attributable to the production cost center.

Direct costs include the following:

Direct costs = Direct materials + Direct wages

Direct materials include raw materials, packing materials etc. used in production process which can be specifically identified to each product/process. Direct wages include the salaries paid to staff such as factory workers who work directly in the production process.

Indirect cost:

Indirect costs are the costs incurred by an entity that are not directly attributable to the production activity of the entity. They are more general in nature and related to the overall functioning of the business.

These costs generally cannot be allocated to a single specific cost center but tend to get allocated across multiple cost centers. These costs include the following:

Indirect costs = Indirect materials + Indirect wages + Other Indirect expenses

Indirect materials include stationery, cleaning supplies which are used across activities/departments

Indirect wages include the salaries paid to non-production specific staff such as office staff, sales staff etc.

Indirect expenses can include security expenses, administrative expenses, rent, and professional consultancy fees etc.

Indirect costs are generally accumulated and allocated across cost centers on the basis of some reasonable allocation base.

Example:

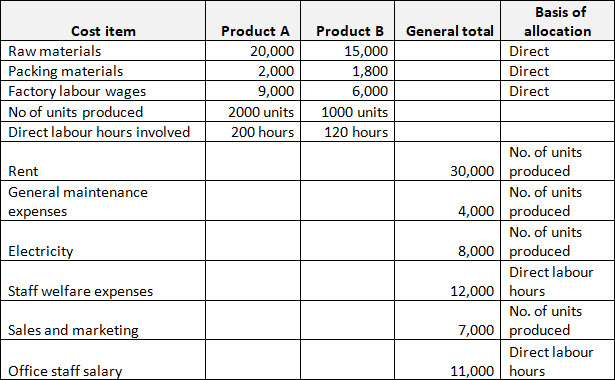

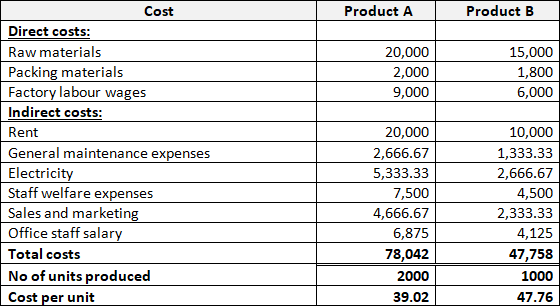

ABC Inc. incurs the following expenses in April 2021:

These costs are identified as direct and indirect costs and are allocated to each product as follows:

Difference between direct and indirect cost

The eight key points of difference between direct and indirect cost have been detailed below:

1. Meaning

- Direct costs are those costs that are directly attributable to the specific production cost center of the entity.

- Indirect costs are those costs that cannot be directly attributed to the core production activity of the entity but are incurred for general functioning of various activities of the entity.

2. Attribution to production activity

- Direct costs have a one-to-one relation with the entity’s production process. They are directly traceable and attributable to the production activity.

- Indirect costs do not have an identifiable one-to-one relation with the entity’s production activity and, therefore, cannot be directly attributed.

3. Costing allocation

- Direct costs do not need to be allocated but are directly attributed to a single cost center. For example, cost of direct materials used in each of the entity’s products are directly attributed to it.

- Indirect costs are generally attributed across multiple cost centers and need to be allocated on the basis of an assigned cost base/cost driver. For example, cost of housekeeping and maintenance can be assigned to each product produced on the basis of number of direct labor hours it employs.

4. Ease of attribution/allocation

- Direct costs can be easily assigned to the related cost center.

- Indirect costs need to be allocated through a more complex cost allocation process. The costs need to be accumulated and then allocated across cost centers on the basis of a reasonable predetermined cost driver.

5. Hierarchy

- In a cost sheet, direct costs are first attributed to each cost center.

- Once all direct costs are attributed, indirect costs are accumulated and allocated across cost centers.

6. Nature

- Direct costs are variable in nature as they vary directly with a change in production level.

- Indirect costs can be semi-variable or fixed in nature, depending on the type of expense incurred.

7. Grouping

- Direct costs are cumulatively termed as prime cost.

- Indirect costs are cumulatively termed as overhead costs.

8. Examples

- Examples of direct costs include raw materials, packing materials, factory workers wages etc.

- Examples of indirect costs include rent, depreciation, electricity, office expenses etc.

Conclusion – direct vs indirect cost

Direct costs being easily traceable are easy to calculate and attribute. Indirect costs, however, are more complex as they need to be appropriately allocated to each cost center. Appropriate classification as well as allocation of both the costs is important because it helps management in assessing the relative profitability of each of its products/cost centers. This can help them to take several decisions such as product pricing, cost control, decision on expansion or reduction of production etc.