Business organisations such as sole proprietors, firms and companies maintain books of accounts to record their business transactions. Double entry system of accounting follows certain standard books of accounts for recording business transactions. These begin with preparation of chart of accounts to preparation of journal, posting to ledger accounts and compiling of trial balance. These books of accounts are the basis for preparing financial statements.

This article looks at meaning of and differences between two basic types of books of accounts – journal and ledger.

Definitions and meanings

Journal:

In accounting, journal is the first and most basic of the books of accounts. All business transactions are recorded through accounting entries commonly known as journal entries in the accounting book namely the journal.

All accounting entries are sequentially recorded for the first time in the journal through accounting entries. It is the book of original entry.

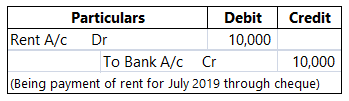

Each accounting entry in the journal has 2 effects – a debit and a credit. An example of an entry made in the journal is:

Payment of rent:

The accounts which are to be debited and credited are determined by adhering to golden rules of accounting which are prescribed for journalizing. Each accounting entry must be supported by a narration which describes in brief the nature of the transaction recorded.

The journal is the base book from which entries are posted to the ledger.

Ledger:

The ledger is a principal book wherein journal entries are classified account wise and posted to individual accounts. It is essentially a set of all real, personal and nominal accounts where transactions affecting them are recorded.

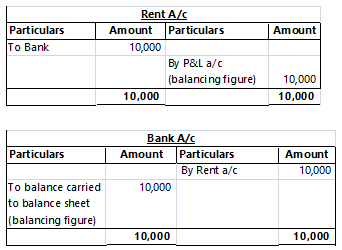

In the above example of journal entry, the same would be posted to both the rent and bank ledgers as follows:

Ledger of each account is maintained in ‘T’ format – with debits on the left and credits on the right. Once all journal entries are posted to their individual ledger accounts, they are balanced and the balances are compiled in the form of a trial balance. This forms the base for preparing the financial statements such as profit and loss account and balance sheet.

Difference between journal and ledger:

The difference between journal and ledger have been detailed below:

1. Meaning

- Journal is the first of the books of accounts wherein all business transactions are first accounted for by journal entries.

- The ledger is a principal book wherein the accounting entries recorded in the journal are segregated and posted to their respective individual accounts.

2. Hierarchy

- Journal is the book of original entry and thus precedes the ledger.

- Ledger is the book of second entry and is prepared after the journal.

3. Base for

- Journal is the base account book for preparation of the ledger.

- Ledger is the base account book for preparation of trial balance and then subsequently the financial statements.

4. Purpose

- The purpose of the journal is to serve as the first account book for recording all business transactions that have monetary impact on the finances.

- The purpose the ledger is to determine balances of all accounts to prepare the trial balance and financial statements.

5. Format

- Journal is prepared in columnar format, with first column for debits and second column for credits.

- Ledger is prepared in ‘T’ format, debits being posted on the left and credits being posted on the right.

6. Manner and sequence in which transactions are recorded

- The process of recording entries in the journal is termed as journalizing.

- The process of recording all entries into respective ledger accounts is termed as posting.

7. Sequence in which transactions are recorded

- Entries are recorded in the journal sequentially date wise.

- Entries are posted in ledger account wise.

8. Need for narrations

- Journal necessary requires narrations after each accounting entry to explain the nature of each transaction.

- Ledger accounts do not require any narrations.

9. Continuity

- Journals are prepared from scratch for each accounting period.

- Ledgers are prepared in continuity, with ledger account balances from one accounting period being carried forward to the subsequent accounting period.

10. Balancing

- Journalizing does not involve any totaling and balancing.

- Ledgers are balanced periodically to determine account balances to be compiled into a trial balance.

Journal versus Ledger – tabular comparison

A tabular comparison of journal and ledger is given below:

|

||||

| Meaning | ||||

| Account book in which all business transactions are initially accounted for | Account book in which journal entries are broken down account wise and posted to the respective individual accounts | |||

| Hierarchy | ||||

| First | Second | |||

| Base for | ||||

| Ledger | Trial balance and financial statements | |||

| Purpose | ||||

| Recording business transactions | Calculating account balances for preparation of trial balance | |||

| Format | ||||

| Columnar | ‘T’ format | |||

| Manner in which transactions are recorded | ||||

| Journalizing | Posting | |||

| Sequence in which transactions are recorded | ||||

| Sequentially, date wise | Account wise | |||

| Need for narrations | ||||

| Necessary | Not necessary | |||

| Continuity | ||||

| Prepared from scratch each year | In continuity from previous accounting period | |||

| Balancing | ||||

| No totaling and balancing done | Account totaling and balancing done | |||

Conclusion – journal vs ledger:

Understanding the manner in which business transactions are accounted for in the journal and ledger is essential as these are the primary books of accounts maintained and are an integral part of the accounting cycle. Once transactions are journalized and posted correctly, a trail balance can be prepared and true and fair financial statements can be drawn up.