Inventory accounting and management are key functions in manufacturing and trading companies. Inventory consists of everything from raw material, production consumables to work in progress and finished goods. Large manufacturing and trading companies have considerable amounts invested in their inventories and thus its accounting and management assumes an even more important role. Inventory accounting involves valuation of inventory on hand at the close of an accounting period as well as valuation of cost of goods sold during that period.

This article looks at meaning of and differences between two types of inventory accounting methods – FIFO and LIFO.

Definitions and explanations

FIFO:

First-in-First-out or FIFO inventory accounting method values inventory (stock in hand and cost of goods sold) on the basic assumption that inventory that is purchased/brought in first will also be utilized/transferred out first.

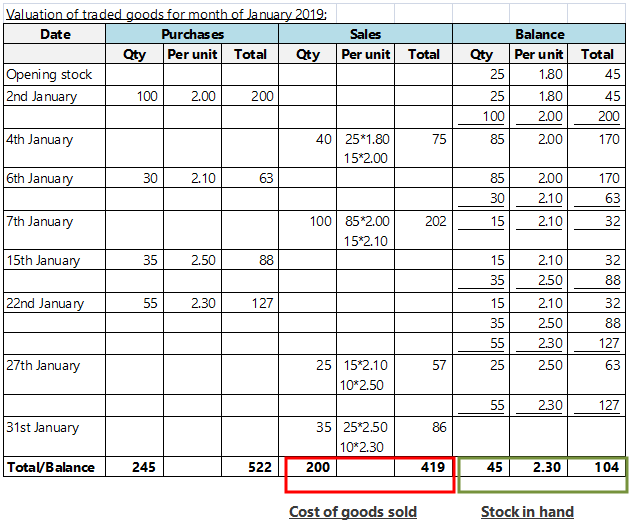

A numerical example of how FIFO method works for a trading company is detailed below:

As is demonstrated above, under the FIFO method, the goods purchased last (on 22nd January) remain in stock on 31st January.

Application of FIFO method has several benefits:

- Entities prefer to sell their older stock first to reduce risk of obsolescence loss, as FIFO is in tandem with this it is considered as a more realistic method of inventory accounting

- Values stock in hand at the latest purchase prices – making the values more current and realistic.

The benefits of FIFO method make it more widely acceptable, being recognized and permitted by both the International Financial Reporting Standards (IFRS) as well as by US GAAP.

FIFO does however suffer from some drawbacks:

- FIFO may not be as accurate in times of high inflation, as current prices may be excessively high whereas cost of goods sold are being valued at older historical prices

- As cost of goods sold at historical prices, FIFO method results in lower charge to profit especially in times of increasing prices. This increases tax cost for the entity as profits are inflated.

LIFO:

Last-in-First-out or LIFO inventory accounting method values inventory (stock in hand and cost of goods sold) on the basic assumption that inventory that is purchased/brought in last will be utilized/transferred out first.

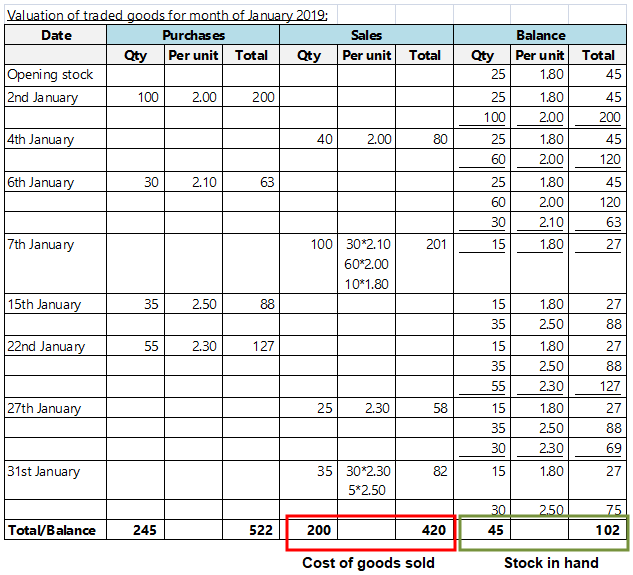

A numerical example of how LIFO method works for the same example above is detailed below:

As is demonstrated above, under the LIFO method, the goods purchased earliest (opening stock and on 15th January) remain in stock on 31st January.

The primary advantage of application of LIFO method is that it matches most current costs with current revenue. LIFO method considers most current stock purchases for valuing cost of goods sold.

This can cause potential reduction in tax cost in an inflationary price environment. In times of rising prices, this will result in higher charge of cost of goods sold to profit resulting lower profit and tax cost.

Due to its impact on reduction in tax cost, LIFO method is not permitted by IFRS. It however continues to be recognized and permitted under US GAAP.

The key disadvantage of LIFO method is that it values at inventory at historical and often very old costs. This leads to understatement and an often unrealistic valuation of stock in hand.

Differences between FIFO and LIFO:

Difference between FIFO and LIFO have been detailed below:

1. Meaning

- FIFO inventory accounting method values inventory (stock in hand and cost of goods sold) assuming that stock brought in the books first is taken out first.

- LIFO inventory accounting method values inventory (stock in hand and cost of goods sold) assuming that stock brought in the books last is taken out first.

2. Goods that remain in inventory

- Under FIFO method, goods bought later will remain in inventory.

- Under LIFO method, goods bought earlier will remain in inventory.

3. Valuation of stock in hand

- Under FIFO method, stock in hand is valued at more current prices hence its valuation is more realistic.

- Under LIFO method, stock in hand is valued at older historical costs.

4. Valuation of cost of goods sold

- Under FIFO method, cost of goods sold is valued at older historical costs.

- Under LIFO method, cost of goods sold is valued at more current prices.

5. Impact of inflation

- In times of rising prices, FIFO method tends to under-value cost of goods sold, this leads to reporting of higher profits. This has a negative impact on tax cost and resultant cash outflow.

- In these circumstances, LIFO method on the other hand would value cost of goods sold at higher prices, leading to a higher charge on profit. This can result in understatement of profit and decrease in tax cost.

6. Impact of deflation

- In times of falling prices, FIFO method may over-value cost of goods sold. This leads to lower tax cost.

- In these circumstances, LIFO method may under-value cost of goods sold. This leads to higher tax cost.

7. Statutory recognition

- FIFO method is recognized and permitted by both IFRS and US GAAP.

- LIFO method is recognized by US GAAP but not permitted by IFRS.

8. Acceptance

- FIFO method, owing to its more realistic approach to inventory valuation is more widely accepted.

- LIFO method on the other hand is considered as a less acceptable inventory valuation method.

FIFO versus LIFO – tabular comparison

A tabular comparison of FIFO and LIFO is given below:

|

||||

| Meaning | ||||

| Inventory valuation assumes stock bought first is sold first | Inventory valuation assumes stock bought last is sold first | |||

| Goods that remain in inventory | ||||

| Goods bought later | Goods bought earlier | |||

| Valuation of stock in hand | ||||

| At more current prices | At historical prices | |||

| Valuation of cost of goods sold | ||||

| At historical prices | At current prices | |||

| Impact of inflation | ||||

| Higher profit reported, higher tax cost | Lower profit reported, lower tax cost | |||

| Impact of deflation | ||||

| Lower profit reported, lower tax cost | Higher profit reported, higher tax cost | |||

| Statutory recognition | ||||

| Permitted by IFRS and US GAAP | Permitted by US GAAP but not by IFRS | |||

| Acceptance | ||||

| More widely accepted method | Less accepted method | |||

Conclusion – FIFO vs LIFO:

Inventory management and accounting is an important focus area, especially for large manufacturing and trading entities. FIFO method follows more realistic approach, in that most entities would also prefer to sell/transfer their older inventory first to reduce the risk of obsolescence. LIFO method on the other hand is a relatively irrational method as it rarely mimics actual physical movement of inventory. This is why FIFO method is far more popular than LIFO method. There are also other methods of inventory valuation which can be adopted by entities, (subject to the jurisdictional GAAP regulations) such as specific identification method and weighted average method.