Assets are vital for any business as they can be a source of future revenue as well as can be a means of meeting liabilities. Valuation of assets is an important part of both financial as well as tax accounting. It also plays an essential role in gauging the net worth of a business.

This article looks at meaning of and differences between two different types of asset valuations – book value and fair market value of assets.

Definitions and meanings

Book value of assets:

The book value of an asset is the amount at which it has been originally recorded in the books of accounts at the time of recording of the related transaction. This means that the book value is determined with reference to balance sheet values on any given date.

Book value for different assets can be derived as follow:

- *Historical cost of purchase for tangible fixed assets

- Cost of development (or purchase) originally recorded for intangible fixed assets

- Amount due as per books of accounts for debtors and other receivables

*Includes original cost paid to purchase the asset plus any subsequent cost incurred upto asset’s physical installation which may include freight and installation charges etc.

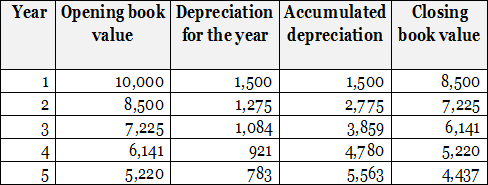

In case of fixed assets, the book value would be reflected as the above amount(s), net of any accumulated depreciation or amortization arisen out of normal wear and tear and impairment. For example, Robert Inc. has purchased machinery for $10,000 at the start of Year 1. As per Robert’s accounting policies, the machinery is to be depreciated at 15% each year by employing a written down value (WDV) method. The book value of the machinery will change each year as follows:

As demonstrated above, the book value of assets that are subject to depreciation or amortization charge changes over time due to continuous yearly charge.

Book value concept is of relevance in businesses that follow historical cost method of accounting. It is more important for asset heavy businesses than service companies which do not rely too much on fixed assets for carrying out their revenue generation activities.

Fair market value of assets:

The fair market value (or fair value for short) of an asset is the monetary amount that the asset can be reasonably expected to fetch in the open market at the prevalent prices. Fair value effectively indicates the true worth of an asset at a given time. There are several approaches which can be applied for the determination of fair market value of assets:

- Market approach:

This involves determination of the market price of an asset by reference to market information on similar assets. - Cost approach:

Determination of replacement cost of the asset i.e., the amount that would be required to replace the asset at current market prices and conditions. - Income approach:

Determination of present value of future cash flows expected to be generated from the operational use of the asset. This method is mostly used when market information on prices is not available.

Fair market value of assets is important when businesses apply fair value accounting. It is also important in the determination of true net worth of a business for which fair value of assets would be relevant.

A practical implication of the fair value concept can be found while accounting for the short term stock investments which are generally valued at their fair market values (FMVs) or net asset values (NAVs) as on the date of balance sheet.

Difference between book value and fair market value of assets

The eight key points of difference between book value and fair market value of assets have been detailed below:

1. Meaning

- The book value of an asset is the amount at which it has been recorded when the related transaction was accounted for.

- The fair market value of an asset is the monetary value that the asset expects to get when sold in the open market.

2. Method of determination

- There is primarily one method of determining book value of assets – identification of historical cost with reference to balance sheet values.

- Fair market value can be determined by one of three methods – market approach, cost approach and income approach.

3. Ease of determination of value

- Book value of assets is easier to determine as it requires reference to reported balance sheet values.

- Fair market value of assets is more complex to determine as it requires detailed information of market conditions and prices. If market prices are not available then information on future cash flows is required.

4. Applicable to method of accounting

- Book value of assets is of relevance in historical cost method of accounting.

- Fair value of assets is of relevance in fair value method of accounting.

5. Relevance of period of time

- Book value considers past or historical costs which have been recorded in the books of accounts at the time of occurrence of the transaction.

- Fair market value, on the other hand, considers current market price or present value of future cash flows. Historical cost has limited relevance.

6. Factors effecting it

- There are only limited factors that may impact change in the book value of an asset. Primarily, these are passage of time and wear and tear in use.

- There are multiple factors that may impact change in an asset’s fair market value. These include market conditions (like competition), demand, supply and availability of buyers etc.

7. Accuracy

- Book values are less accurate in reflecting true net worth of a business as they reflect past costs, not the current fair market values.

- Fair market values are more accurate in reflecting true net worth as they consider prevalent market prices.

8. Examples

- Book value concept is more relevant for fixed assets such as plant and machinery and such tangible assets which are recorded at cost and depreciated over time.

- Fair market value concept is more relevant for assets whose values vary significantly in relation to market conditions such as stock investments etc.

Book value versus fair market value – tabular comparison

A tabular comparison of book value and fair market value is given below:

|

||||

| Meaning | ||||

| Transaction value at which asset has been recorded | Money value that can be expected to be received in case the asset is sold in the open market | |||

| Method of determination | ||||

| One method – reference to balance sheet values | Three methods – market approach, cost approach and income approach | |||

| Ease of determination | ||||

| Simple to determine | Relatively complex to determine | |||

| Applicable to method of accounting | ||||

| Historical cost method | Fair value method | |||

| Relevance of period of time | ||||

| Considers past or historical costs | Considers prevalent market price or present value of expected cash flows | |||

| Factors affecting it | ||||

| Limited factors | Multiple factors | |||

| Accuracy in determination of net worth of business | ||||

| Less accurate | More accurate | |||

| Example | ||||

| Plant and machinery are valued at original cost of purchase less accumulated depreciation | Stock investments or marketable securities are recorded at net asset or fair market values | |||

Conclusion – book value vs fair market value of assets:

The key difference between book value and fair market value of assets is that the former equals the asset’s total cost (including installation etc.) less its accumulated depreciation (if any) while the later equals the price which the asset can realize if sold in the open market.

Both the values are used to determine net worth of a business. Which one of the two is more useful depends on the information needs of each individual user. Investors can compare the net worth resulting under these two methods to gauge whether a business is correctly valued or not. To determine the true worth of a business, the fair values of assets are more relevant than the book value.