Definitions and meanings

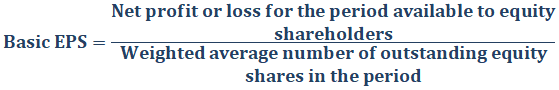

Basic EPS:

Basic earnings per share (EPS) means the profit earned per equity share. It is calculated by the following formula:

The net profit or loss available to equity shareholders means the net profit/loss available after distribution of dividend (and tax thereon) to preference shareholders.

Weighted average outstanding equity shares are calculated considering any fresh issue or buy-back of equity shares during the period.

Basic EPS, reported by companies in their financial statements, is an important tool to assess the profitability of a company. This is a better investor tool as it assesses the profitability to an investor per share as against looking at net profitability of the company in isolation.

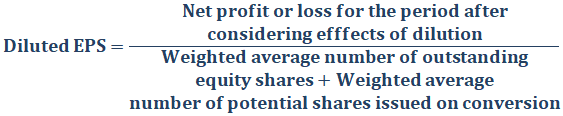

Diluted EPS:

Diluted EPS means the profit earned per share considering all convertible securities which can potentially be converted into equity shares. These can include debentures, preference shares, term loans, employee stock options that can be converted into equity shares at a later date.

Diluted EPS is calculated by the following formula:

To calculate net profit or loss for the period after considering effects of dilution, the following adjustments are made to net profit/loss available to equity shareholders:

- Preference dividend (and tax thereon) if deducted

- Interest expensed in the period on the convertible securities

- Any other expenses that would result from conversion of securities into equity shares

Securities are considered as dilutive when their conversion to equity would result in decrease of net profit per share. If conversion of a security results in increase in net profit per share then it is considered an anti-dilutive and not considered in the calculation of Diluted EPS.

Diluted EPS is generally lower than basic EPS. Diluted EPS is a beneficial analysis tool for investors as it considers the effect of dilutive securities that can convert in the future. These can potentially impact the profitability of their investment and is thus a useful analysis tool for current and potential investors.

Difference between basic EPS and diluted EPS:

The differences between Basic EPS and Diluted EPS have been detailed below:

1. Meaning

- Basic EPS is profit earned per outstanding equity share.

- Diluted EPS is the profit earned per equity share, if all convertible securities were exercised and converted to equity shares.

2. Profit/loss considered

- Basic EPS considers net profit/loss available to equity shareholders only.

- Diluted EPS considers net profit/loss available to equity shareholders after considering all dilutive adjustments – add back of preference dividend, interest on convertible instruments and deduction of any expenses incurred on conversion.

3. Securities considered

- Basic EPS considers all outstanding equity shares on the date of calculation. These include all right shares and bonus shares that may have been issued during the period.

- Diluted EPS considers all outstanding equity shares plus all convertible securities which can potentially be converted into equity shares. These include convertible debentures, convertible preference shares, employee stock options and convertible term loans.

4. Net result

- Basic EPS is higher than Diluted EPS as it does not consider the effect of dilution on profit.

- Diluted EPS considers the effect of dilution (i.e., conversion of securities into equity shares) on profit.

5. Investor significance

- Basic EPS is a simple measure of investor profitability per share.

- Diluted EPS is a more significant tool for investors as it measures the potential impact on investor profitability of future capital conversion or expansion. This can help investors understand their profitability per share on the occurrence of certain events such as conversion of debt, exercise of management or employee stock options etc.

6. Ease of calculation

- Calculation of basic EPS is simpler and can be done on the basis of figures easily available in prepared financial statements.

- Calculation of diluted EPS is more complex as it involves conversion of all potential securities into equity shares. This requires determination of more complex conversion formula, conversion consideration and conversion dates.

7. Suitability

- Basic EPS as a measure is more suited for companies that have a simple capital structure.

- Diluted EPS as a measure is more suited for companies which have a complex capital structure divided into several classes and categories of securities.

Basic EPS versus diluted EPS – tabular comparison

A tabular comparison of Basic EPS and Diluted EPS is given below:

|

||||

| Meaning | ||||

| Profit per equity share | Profit per equity share, considering all convertible securities are exercised | |||

| Profit considered | ||||

| Profit available for distribution to equity shareholders | Profit available for distribution after considering adjustments for potential dilution | |||

| Securities considered | ||||

| Weighted average outstanding equity shares | Weighted average outstanding equity shares + weighted average potential equity shares issued on conversion | |||

| Comparative value | ||||

| Higher | Lower | |||

| Investor significance | ||||

| Lower, as a basic measure of profitability | Higher, as considers effect on profitability of potential dilution | |||

| Ease of calculation | ||||

| Simpler | More complex | |||

| Suitability | ||||

| Companies with simple capital structure | Companies with varied and complex capital structure | |||

Conclusion – basic EPS vs diluted EPS:

EPS is considered to be a better measure to assess profitability for an investor as against considering net profitability in isolation. While both are used for assessing profitability and financial health, diluted EPS is considered as a more conservative and useful EPS measure. A high difference between basic EPS and diluted EPS can indicate a risk of high dilution which investors consider while analyzing financial statements of a company.