Incurrence of costs in a commercial business is inevitable. They are incurred at each stage of the business operation and are a must to ensure the entities’ smooth functioning. However, the higher the costs of a business, the lower its overall profitability. Thus, business entities always need to focus on managing and controlling their costs.

Cost control involves the identification of costs and a set of steps to be implemented to reduce them without adversely impacting the business operations. The first step of cost control is thus to determine the costs. For this purpose, bifurcation of costs into different groups or categories and identifying the factors that impact their incurrence is important.

This article looks at meaning of and differences between two such cost bifurcations, based on their amenability to control – controllable and non-controllable costs.

Definitions and meanings

Controllable costs:

Controllable costs are those cost items that can be managed or altered in the short term period through specific management decision(s). In other words, a cost is regarded as controllable if a manger has the authority to decide on its incurrence or non-incurrence, or to decide on the amount of cost that must be incurred. The management can thus alter these costs on a need basis. Controllable costs can include the following:

- Direct variable costs: Costs incurred on direct materials and production labor can be controlled by altering the level of production, improving/upgrading work conditions to raise efficiency and reduce wastage of inputs and time resources etc.

- Other employee costs: Employee costs can be controlled by reducing staff size, implementing training and motivational programs to enhance performance of existing employees, improving activities and processes to prevent unnecessary duplication of work and effort and negotiating compensation packages etc.

- Marketing costs: Marketing and advertising costs are aimed at promoting brands and products, widening market share and boosting sales revenue for the business. The management can thus decide the amount it wishes to allocate towards such promotional activities on the basis of budget availability.

Controllable costs are identified at each managerial or decision-making level. This is because what cost is controllable for one manager may not be for the other. For example, training costs may be determined by senior management personnel and thus would be controllable at this level but may become a non-controllable cost for the production manager.

Non-controllable costs:

Non-controllable costs are those costs which cannot be avoided or altered by management decision(s), especially in the short run. The major reasons why a cost becomes non-controllable are that it is either fixed in nature or arises as a result of some kind of mandatory influence or power of one or more external parties.

The costs that qualify as uncontrollable due to their fixed nature include those expenses that have been committed and must be incurred irrespective of the level of output the business generates. Examples include rental payment, interest on a long-term loan and periodic depreciation charge etc.

Uncontrollable costs that arise on account of external parties’ power or influence include charges levied by an external source such as the government or a third party under a contractual obligation, which the management cannot alter. Examples include taxes and duties imposed by government and minimum contractual payments made to external parties etc.

Although non-controllable costs cannot be altered in the short-term, they may be subject to control over a longer time period. For example, on expiry of a contract, management can negotiate the rent or license fees which were subject matter of the initial contract. This can convert costs which are non-controllable over the short-term into controllable costs over a longer period.

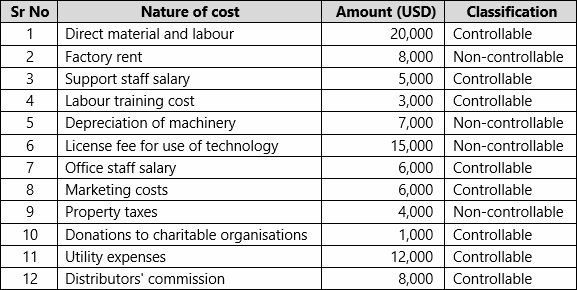

The top management of Western Inc. has charted out the following costs for the year 2021. They are to be bifurcated into controllable and non-controllable costs as follows:

Difference between controllable and non-controllable costs

The nine key points of difference between controllable and non-controllable costs have been listed below:

1. Meaning

- Controllable costs are those costs which can be, over a short term, subject to cost control through management decisions.

- Non-controllable costs are those costs that cannot be altered, controlled or impacted by management over a short time period.

2. Applicable time period

- Controllable costs are amenable to control both over the short term and the long term.

- Non-controllable costs are not amenable to control over a short time period; they may, however, be controlled and altered over a longer time period.

3. Nature

- Controllable costs tend to be variable i.e., they can be increased or decreased fairly quickly.

- Non-controllable costs most of the time tend to be fixed in nature or externally imposed i.e., they must be incurred and are unlikely to be reduced over a short period.

4. Driving force behind costs

- Short term management decisions are the key driving force behind controllable costs.

- Non-controllable costs are incurred due to several reasons such as long-term fixed cost commitments, government mandatory levies and contractual obligations etc.

5. Frequency of monitoring

- Controllable costs are monitored frequently and various steps are taken to control them.

- Non-controllable costs are practically unavoidable and thus are not monitored frequently. They are generally revisited every few years when they can be altered.

6. Decision making authority

- Decision making authority, in case if controllable costs, generally vests with the manager with whom the prerogative for incurring and modifying the cost lies.

- The decision-making authority for non-controllable costs generally vests only with top management; for example, negotiation of rental contracts, implementation of large-scale tax saving measures etc. mostly take place at the top hierarchal levels.

7. Impact on short term profitability

- Controllable costs can be altered to impact the short term profitability.

- Non-controllable costs impact profitability but they cannot be altered to improve short-term profitability.

8. Considered in employee/managerial appraisal

- Managers are generally appraised for how efficiently they are able to manage, control or reduce the controllable costs.

- Managers are generally not appraised on the basis of non-controllable costs as they are outside the purview of their authority.

9. Examples

- Examples of controllable costs include direct materials, employee costs, advertising costs, distribution costs etc.

- Examples of non-controllable costs include government taxes, rent, depreciation, insurance etc.

Conclusion

The key point of difference between a controllable and non-controllable cost is that the former is subject to control through routine managerial decisions and actions while the latter one cannot be impacted by management in short run without facing serious trouble or business disturbance.

Bifurcation of costs into controllable and non-controllable categories is a subjective exercise and is based on managerial decision-making authority. Thus, these costs are generally classified both at an individual departmental as well as overall enterprise level. Such bifurcation is important to help management identify where their attention should be focused so as to save organization’s resources, control cost and improve profitability. Also, this categorization is an effective tool for appraising management performance by assessing how well individual managers have been able to control their controllable costs.