A company may opt for funding its business through capital contribution. The contributors of capital are called shareholders and receive a share of profit distributed by the company in the form of dividends. This mode of funding results in giving up part ownership of the company but is not accompanied by any fixed interest obligation like that in the case of debt funding. Share capital of a company represents the funds raised (or the funds that can be raised) by a company through the issue of its shares. This represents the ownership structure of a company with each share representing a part ownership of the company.

This article looks at meaning of and differences between two different categorizations of share capital – authorized share capital and issued & paid up share capital.

Definitions and meanings

Authorized share capital:

Authorized share capital is the maximum value of share capital (face value) that can be raised by a company by issue of shares as specified by the its charter documents. The company’s charter documents include its memorandum and articles of association.

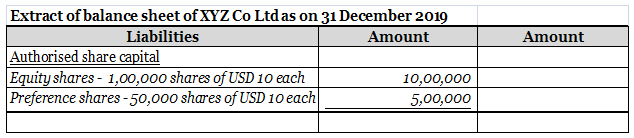

A different authorized share capital may be specified for different classes of shares – for example for equity shares and for preference shares. Authorized share capital can be reported in the balance sheet as follows:

It is important to note that authorized share capital is disclosed in a company’s balance sheet only for information purpose and does not form part of the value of liabilities side in the balance sheet.

When a company chooses to raise funds by issue of shares, it can do so up to the value of authorized share capital. If it requires raising funds in excess of this it must first increase its authorized share capital by obtaining shareholder approval.

Issued and paid up share capital:

Issued and paid up share capital is that portion of authorized share capital that has been raised by issuing shares to share holders, for which full payment has been made by the shareholders to the company.

When a company chooses to raise funds through capital contribution, it can convert any part of its authorized share capital to issued share capital by issuing shares. The recipients of these shares become shareholders of the company who pay the company to acquire these shares. If the entire face value of the issued shares is remitted by the shareholders to the company then the issued share capital is also paid up share capital.

Issued and paid up share capital represents the amount of investment made in the company by its shareholders.

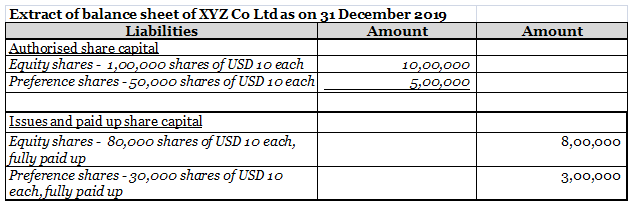

Issued and paid up share capital is reported below authorized share capital in the balance sheet as follows:

Difference between authorized and issued & paid up share capital:

The difference between authorized and issued & paid up share capital has been explained in the following points:

1. Meaning

- Authorized share capital is the maximum extent of funding that can be raised through issue of shares. It is laid out in the company’s charter documents.

- Issued and paid up share capital is the part of authorized share capital against which shares have been issued to share holders of a company against full payment.

2. Represents

- Authorized share capital represents the maximum possible funding that a company is allowed to raise through issue of shares.

- Issued and paid up capital represents the shareholders’ investment in the company.

3. Timing of determination

- Authorized share capital is determined and specified at the time of incorporation of the company.

- Issued & paid up share capital is determined when the company decides to raise funds through issue of shares.

4. Immediate monetary impact

- Authorized share capital does not have immediate monetary impact on the finances of the company until it is issued to shareholders.

- Issued and paid up capital has immediate monetary impact on the finances of the company as it results in money inflow for the company.

5. Accounting entry

- As authorized share capital does not impact finances till it is issued, no accounting entry is passed for it in the books of accounts.

- Issued and paid up share capital is accounted for in the books of accounts when the issued shares are paid for by the shareholders.

6. Relevance in balance sheet

- Authorized share capital is reported in the balance sheet for information purpose only. The value of authorized share capital is not considered in the totaling of the balance sheet.

- Issued and paid up share capital is accounted for in the balance sheet and considered in the totaling of the balance sheet.

7. Increased by

- Authorized share capital can be increased only by obtaining shareholder approval and undertaking all mandatory corporate compliances.

- Issued and paid up share capital can be increased by issuing shares to existing or new shareholders.

8. Subset of

- Authorized share capital represents the maximum possible share capital than can be raised i.e.: both issued and unissued share capital.

- Issued and paid up share capital is a subset of such authorized share capital which has actually been raised.

Authorized versus issued & paid up share capital – tabular comparison

A tabular comparison of authorized and issued & paid up share capital is given below:

|

||||

| Meaning | ||||

| Maximum amount of share capital (face value) that a company is permitted to raise | Part of authorized share capital for which full payment has been received against issue of shares | |||

| Represents | ||||

| Maximum permissible amount that company can raise by issuing shares | Actual investment of shareholders in the company | |||

| Timing of determination | ||||

| At the time of incorporation of the company | At the time of raising capital through issue of shares | |||

| Immediate monetary impact | ||||

| No | Yes, inflow of money. | |||

| Recorded through accounting entries | ||||

| No | Yes | |||

| Relevance in balance sheet | ||||

| Only for disclosure purpose and not calculated while totaling of balance sheet | Calculated while totaling balance sheet | |||

| Increased by | ||||

| Approval of shareholders. | Issuance of shares. | |||

| Subset of | ||||

| Represents the whole – both issued and unissued share capital. | Represents a part of authorized share capital. | |||

Conclusion – authorized vs issued & paid-up share capital:

It is necessary to note that both authorized and issued & paid up capital are recorded in the books at their face value. In reality, companies may issue shares at their market value which may often be higher than their face value. The difference between the market value and face value of the issued shares is not recorded through the share capital account but through a separate share premium account which forms part of reserves of the company.