The core purpose of making any business investment is to earn a return on it. Business entities may invest their funds into several projects with the intent of earning profits. All these profit making ventures, however, may require large upfront initial investments while the returns tend to accrue in instalments over the years. An entity may have several business proposals from which it may have to choose the most profitable. Thus, they apply capital budgeting techniques to evaluate the profit potential of each business proposition.

Certain capital budgeting techniques provide for calculation of the percentage rate of return that a project will earn on its investment. This article looks at meaning of and difference between two types of such rate of return calculations – accounting rate of return (ARR) and internal rate of return (IRR).

Definitions and meanings

Accounting rate of return (ARR):

Accounting rate of return (ARR) is the percentage calculation of the periodic profit/return that a project is expected to earn on its initial investment.

The formula for calculating ARR is:

ARR = (*Average annual profit from the project/Initial investment cost of the project) × 100

*Average annual profit is calculated by subtracting all the expenses incurred that are related to the project from the income generated by the project for a year.

Example

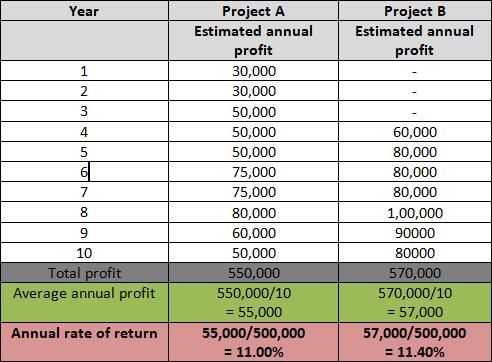

XYZ Inc. has two business proposals, Project A for a solar plant and Project B for a recycling plant. Both projects require an initial investment cost of $500,000. The estimated annual profits from both these projects are as follows:

As per the above calculation, Project B has a better ARR of 11.40% vis-à-vis 11.00% of Project A.

Calculating ARR is a quick method of calculating the comparative returns from multiple projects that a business entity is considering. It can help the entity take a decision on which project is likely to be more profitable.

ARR however suffers from one major drawback, that it does not consider the time value of money. Income accruing from the project in all future years are considered at the same value, hence ARR fails to distinguish between projects that generate higher income in earlier years vis-à-vis projects that generate the same income in later years. This can lead to erroneous conclusion while evaluating comparative profitability of projects.

Internal rate of return (IRR):

The internal rate of return (IRR) is the return percentage that a project is expected to generate over its life. It is essentially the rate at which the net present value of the future cash inflows of a project equals the value of its outflow i.e., the rate at which the NPV of the projects equals to zero.

IRR is a capital budgeting technique utilized to assess the yield that a project will generate. Entities can use IRR to compare projects and evaluate their comparative returns. It can also be used to analyze the feasibility of a single project – in this case management considers cost of capital as the minimum threshold that they require a project to generate, if the IRR exceeds this rate the project will be accepted whereas if it falls short the project will be rejected.

The formula for calculating IRR is a complex algebraic formula. To calculate the IRR of a particular project its initial cash outflow is plotted against all subsequent cash inflows expected through its life. The IRR can be calculated with the help of an IRR table or IRR formula in excel.

Example

ABC Inc. is contemplating setting up a solar power plant. It has an existing recycling plant that it can also choose to expand. Both would require a capital investment of $5,00,000. The recycling plant gives a return of 12%. ABC Inc. wishes to analyze whether the solar power plant project is a better business proposition.

The solar plant will have a useful life of 25 years and will generate $75,000 for the first 10 years and $60,000 for the next 15 years. By using the IRR formula in excel, the IRR works out to 13.68%.

Thus, ABC Inc. can opt for putting up a solar plant which will give a return of 13.68% annually vis-à-vis expanding the existing recycling plant which is giving a return of 12%.

The key drawback of ARR that it disregards the time value of money is overcome by using IRR. IRR operates on the premise that the value of money today is more than its value in future years. This is owing to the earning capacity of money.

Difference between accounting rate of return (ARR) and internal rate of return (IRR)

The difference between accounting and internal rate of return are detailed below:

1. Meaning

- ARR is the annual average profit that a project earns on its initial capital investment.

- IRR is the yield percentage that a project is expected to give over its useful life.

2. Calculation

- ARR is calculated by dividing the average annual profit by the project’s initial investment and is represented as a percentage.

- IRR is the rate at which the net present value of the net cashflows (i.e., present value of future cash inflows less value of cash outflow) of the project is zero.

3. Time value of money

- ARR calculation does not consider the time value of money. It regards profits earned in all future years as having the same value today.

- IRR calculation considers time value of money as it discounts all cash flows to their present value.

4. Profits v/s cash flows

- ARR calculation considers the profits generated from the project. It thus considers all non-cash expenses along with cash expenses.

- IRR calculation considers only cash inflows generated from the project. Thus, non-cash expenses such as depreciation and other unpaid accruals are ignored.

5. Complexity of calculation

- Calculation of ARR is a simple mathematical formula.

- Calculation of IRR involves a more complex algebraic formula. Hence, the help from calculation tools such as IRR tables and excel formulas are taken.

6. Weightage to timing of profit/cash flow generation

- ARR gives equal weightage to profit earned across all years.

- IRR considers net values and gives higher weightage to earlier cash flows.

7. Advantages and disadvantages

- The main advantage of ARR is that it is easy to calculate and it can quickly give a snapshot of comparative profit of different projects. The main disadvantage, however, is that it does not consider the time value of money.

- The main disadvantage of ARR is actually the advantage of IRR. As it considers the time value of money, it is considered more accurate than ARR. Its disadvantage being that it is complex to calculate and that it can give erroneous results if there are negative cash flows during the project’s life.

Conclusion – ARR vs IRR

Both ARR and IRR are capital budgeting techniques used by entities to evaluate financial viability of business projects. ARR is typically benchmarked against a minimum profit margin set by management whereas IRR is generally benchmarked against the cost of capital for the entity. These techniques though advantageous have certain drawbacks which often makes it necessary to apply these in conjunction with other capital budgeting techniques.