Projects mostly require a significant amount of funds for their completion. The value of investments depends on the scale and type of project to be set up. Entities use capital budgeting techniques to evaluate the potential profitability of any project. This means application of economic analysis techniques to gauge the returns that a specific project investment can generate. This helps entities decide whether a specific business model or project is worth investing in. One such capital budgeting technique is the payback period method.

The article “simple vs discounted payback period method” looks at meaning of and differences between two variants of the payback method – simple and discounted payback method.

Definitions and meanings

Simple payback period method:

Simple payback method is a capital budgeting technique that calculates the time period within which the net cash inflows of a project will repay the initial capital cost of the project. It essentially calculates the break even point of the project.

Example

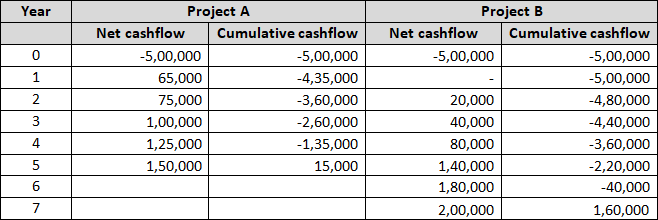

ABC Inc is considering investing $500,000 in 2 different projects. Project A is a retail store and Project B is a solar power project. Its cash inflows over the next 7 years are as follows:

As can be seen the cumulative cash flows of both the projects turn positive in different years. The payback period of Project A is a little over 4 years whereas the payback period of Project B is a little over 6 years.

Under this method, typically projects with higher gestation period will have a higher payback period than projects with a lower gestation period.

This method is useful in comparing multiple projects. The project with the shortest payback period may be selected.

The disadvantage of this method is that it restricts itself to evaluating the payback of only the initial investment – it does not evaluate the subsequent returns or profitability of the project. Further it does not consider the time value of money while accounting for the future cash inflows of the project.

Discounted payback period method:

This is a payback method which calculates the time period within which the initial investment will be recouped after considering the present value of future cash inflows of the project. It thus uses the discounted cash flows i.e., future cash flows are discounted to their present value. The cost of capital is considered to discount the cash flows.

The rationale of applying this method while evaluating a project is the consideration of the earning capacity of money. This means that a sum of money received today is worth more than the same sum of money received in the future. This is because money received today can earn returns and be worth more in the future.

Example

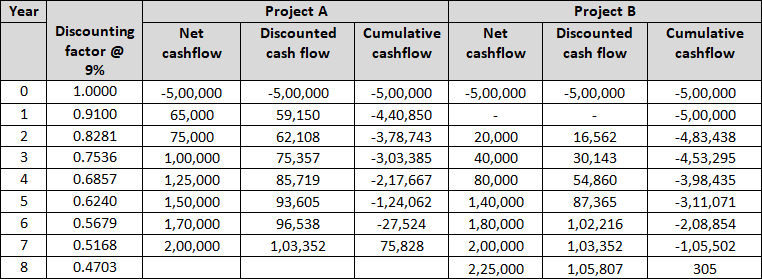

Continuing the same example above, we will calculate the payback period using the discounted payback method. Cost of capital at 9% is used.

The payback period for Project A has increased from over 4 years to over 6 years. Whereas for Project B has increased from over 6 years to over 7 years.

The disadvantage of ignoring time value of money in the simple payback method is overcome while using the discounted payback method.

The other project evaluation techniques that consider the time value of money (i.e., uses discounted cash flows) are NPV and IRR method.

Difference between simple and discounted payback period method:

The difference between simple and discounted payback period method are detailed below:

1. Meaning

- Simple payback method calculates the length of time within which the future cash inflows of a project can recover its initial cost.

- Discounted payback method calculates the length of time within which the initial cost of a project will be recovered if the cash inflows are discounted to their present value.

2. Time value of money

- Simple payback method does not consider the time value of money in its calculations.

- Discounted payback method considers the time value of money.

3. Calculation of net cash inflows

- In simple payback method, the net cash inflows are considered at their future values itself.

- In discounted payback method, the net cash inflows are discounted to their present value by applying the cost of capital of the entity.

4. Complexity of calculation

- Simple payback method is a simpler calculation method.

- Discounted payback method is a more complex calculation as the discounting factor has to be accounted for.

5. Accuracy

- Simple payback method is a less accurate representation of the break-even point of a project as it disregards the time value of money.

- Discounted payback method is more accurate as by applying the cost of capital, it considers the time value of money.

6. Weightage to

- Simple payback method gives equal weightage to all cash inflows.

- Discounted payback method gives higher weightage to cash inflows accumulating in earlier years vis-à-vis cash inflows accumulating in later years.

7. Result

- The payback period resulting from the simple payback method will be shorter than the discounted payback method. This is because the discounted payback method reduces the value of cash inflows of the project.

- Since the discounted payback method considers discounted cash flows, the project’s payback period obtained under this technique will be longer than the simple payback method.

Conclusion – simple vs discounted payback period method:

While both these techniques are useful in evaluating projects, the discounted method is preferred due to its higher accuracy. Both these methods however consider only the break-even point of a project, they thus suffer from the same drawback. These methods do not consider the subsequent cash flows of the projects and thus ignore overall profitability of the project. So, while these methods can be used to gauge the initial cost recovery, they should be used in conjunction with other capital budgeting techniques to evaluate the overall profitability and viability of the projects.